Cyprus: Hope Trumps Reality

More on:

Cyprus has reached a tentative agreement with the IMF-EU-ECB team (Troika) on the economic program that will be backed by its €10 billion rescue package. The IMF will put €1 billion, small in absolute terms and relative to the one-third share that it has had in most of its European programs but a very high share (563 percent) of Cyprus’ contribution, or quota. The plan is for European political approval in coming days, followed by legislative approval where needed during the course of April, and IMF Board approval in early May. If Cyprus passes all the prior actions required in the program, it could get the first drawing on the package in mid-May, well ahead of their early June debt maturities.

The critical prior actions are fiscal. On top of a 5 percent of GDP multi-year fiscal consolidation already underway, the government has committed to pass an additional 2 percent of GDP in new, permanent measures for this year as a condition for receiving its first drawing under the program. In future years, 4 ½ percent of GDP in measures will be passed, and if performance falls short of targets, the government must stand ready to take additional measures (though presumably slippages due to a larger-than-expected recession, rather than incomplete policy implementation, may be excused). The prior actions include significant increases in taxes on corporate income (from 10 to 12 ½ percent), interest income (from 15 to 30 percent), property, and banks, as well as higher fees for health care and government services.

There are also a broad and ambitious set of structural reforms, including fiscal management, privatization/commercialization of state-owned agencies, and pension reform. While not prior actions, it does look like they have to take substantial steps by the first review (presumably slated for this summer, though it could be delayed), and this is another reason to question how long the program can remain on track.

Overall, it’s hard to take this program very seriously as a document of what can and will happen, rather than what creditors would like to see happen. It further will play right into the hands of those who criticize Europe for ignoring the contractionary effects of excessive fiscal consolidation in the crisis. The Fund anticipates this criticism: “The second pillar entails an ambitious and well-paced fiscal adjustment that balances short-run cyclical concerns and long-run sustainability objectives, while protecting vulnerable groups.” However, against the backdrop of a frozen banking system that will need major further deleveraging and a sharp fall in economic activity already in train, it’s hard to square that judgment with the numbers.

To put the fiscal point in context, a rough guess is that the fiscal drag in the program for this year alone will be on the order of 4 ½ percent of GDP. The effect on the economy will be multiplied: the Fund’s work suggests a multiplier of 1.7 or so in a declining growth and low interest rate environment, resulting in a GDP hit of perhaps 7 ½ percentage points. This doesn’t account for capital controls that make it even harder for individuals and firms to smooth or adjust to the effects of these new taxes, so this estimate may be low.

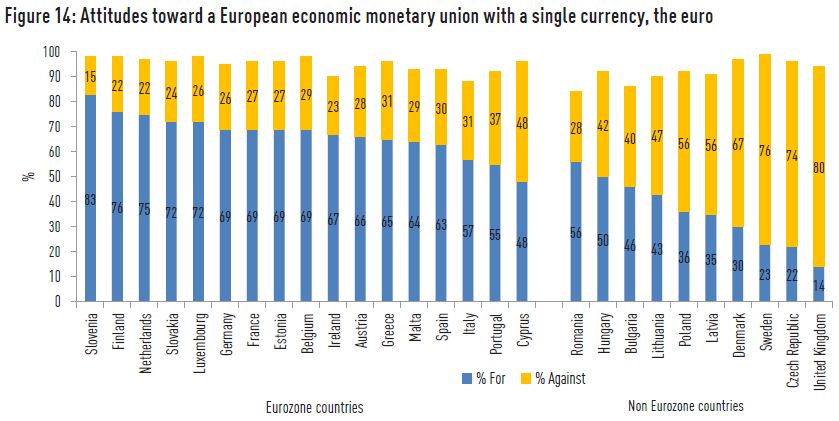

It will be interesting to see if the government has trouble mobilizing support in parliament for this package. The presumption of analysts wiser than me is that the hard decisions have been taken with the bank restructuring, and incentives in Cyprus and elsewhere in Europe are strongly supportive of getting this deal done. The one caution in this regard comes from a recent survey that found that support for the euro outstripped opposition in all countries in the Eurozone…except Cyprus, where sentiment was balanced (see below). If it goes down to the wire, we may find that Cyprus event risk isn’t over yet.

More on:

Online Store

Online Store