- China

- RealEcon

- Topics

-

Regions

Featured

-

Explainers

Featured

Interactive by Olivia Angelino, Thomas J. Bollyky, Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

-

Research & Analysis

Featured

Featuring Zongyuan Zoe Liu via U.S.-China Economic and Security Review Commission June 13, 2024

-

Communities

Featured

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023

-

Events

Featured

Virtual Event with Emma M. Ashford, Michael R. Carpenter, Camille Grand, Thomas Wright, Liana Fix and Charles A. Kupchan June 25, 2024 Europe Program

- Related Sites

- More

April 1, 2013

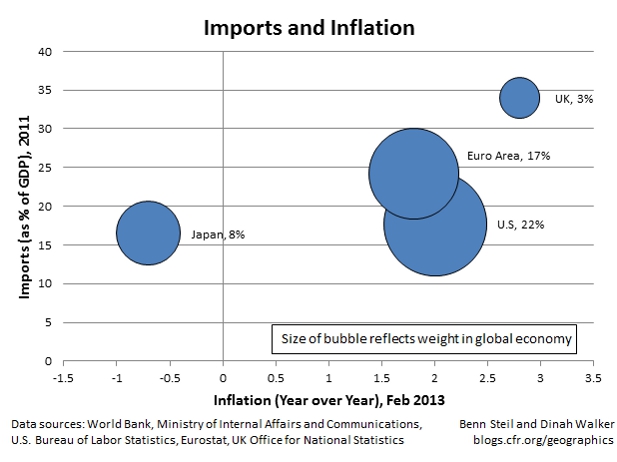

Europe and EurasiaProminent economic commentators have argued the cases for significantly weaker currencies in each of the world’s major economies – in particular, the United States, the eurozone, Japan, and the UK…

November 3, 2014

Europe and EurasiaRelentlessly falling inflation is bad news for Eurozone banks. It increases the real (inflation-adjusted) value of borrower debt and the real cost of servicing that debt. It causes loan defaults…

February 12, 2013

Monetary PolicyBig-name economists have been lining up to show their support for yet another target-based approach to monetary policy making: nominal gross domestic product level (NGDP) targeting. The basic idea…

May 3, 2022

United StatesTrust in the U.S.-led economic and geopolitical order has been eroding. The Russian invasion of Ukraine and the U.S. response to it, whatever its merits, may be the last straw for the global monopoly…

November 6, 2013

Europe and EurasiaBack in April, we showed that the eurozone countries most in need of lower corporate borrowing rates benefited only marginally from ECB rate cuts. Today’s Geo-Graphic shows that little has changed…

Online Store

Online Store