Transportation Infrastructure: Moving America

The U.S. transport system is badly in need of infrastructure investment, and the country could suffer competitively if the status quo persists.

Last updated October 14, 2014 8:00 am (EST)

- Backgrounder

- Current political and economic issues succinctly explained.

Introduction

Infrastructure is critical to economic growth, but the aging U.S. transportation system suffers from insufficient investment. As this CFR Progress Report and Scorecard, Road to Nowhere, explains, other nations are building new highways as the United States’ crumble. U.S. transportation fell from fifth in the World Economic Forum’s rankings in 2002 to twenty-fourth in 2011, passed by nations such as Spain, South Korea, and Oman. Making a U-turn will take some time since major infrastructure projects require several years to plan and execute.

The decline can be attributed to a general trend of under-investment in infrastructure; the American Society of Civil Engineers (ASCE) has only awarded overall grades of D or D+ to U.S. infrastructure in all five report cards issued from 1998 to 2013. Current infrastructure requires more investment—for instance, one in nine U.S. bridges are structurally deficient—while new projects are needed to address issues such as road congestion, which costs American drivers $101 billion annually in wasted time and fuel, and airport delays that are a $22 billion drag on the economy.

More on:

While experts have been warning about crumbling infrastructure for more than a decade, the federal government has not addressed underinvestment. The Obama administration has attempted to prioritize transportation infrastructure by making it the second largest component of the 2009 Recovery Act, and proposing the GROW AMERICA Act to provide four years of comprehensive funding to modernize highways, railways, and mass transit. But the former was a temporary measure and the latter is unlikely to gain traction in Congress. Aside from the Recovery Act and a two-year reauthorization plan passed in 2012, Congress has only passed short-term reauthorizations to keep the Highway Trust Fund afloat.

Investing for Tomorrow

U.S. transportation infrastructure requires substantial capital investment because many of the highways and bridges built decades earlier are now reaching the end of their expected lifespan. For the last few decades, the nation has benefited from investments from the Eisenhower era through the 1980s. From the 1980s onward, transportation infrastructure spending as a share of U.S. GDP stagnated.

Experts generally agree that building infrastructure directly adds to short-term economic gains through the construction effort, and over the long term enables continued growth, though estimates of the level of return vary widely. There is also typical agreement that there are diminishing returns, and that other factors will affect how much of the potential gains will be realized.

Economists of the Federal Reserve Bank of San Francisco [PDF] analyzed highway spending projects and localized economic growth and concluded that spikes in spending led to economic growth both immediately and in the medium term (six to eight years), but did not appear to accelerate growth beyond ten years. Standard and Poor’s calculated that a $1.3 billion project will create an immediate real economic gain of $2 billion, with an unknown positive long-term effect. The World Economic Forum calculated a long-term gain of five to twenty-five cents on annual GDP for every dollar spent on public infrastructure. For private investors in Australia, it’s estimated that infrastructure investments in the mid-1990s yielded 7 to 8 percent annually, with favorable risk exposure.

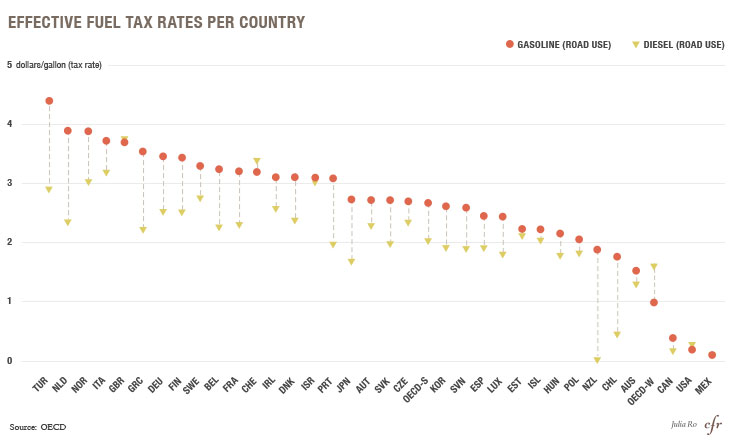

The entire world faces a large infrastructure challenge. McKinsey & Company estimates that the world will require $57 trillion in new infrastructure (including power, water, telecom, etc.) by 2030; global infrastructure spending was $4 trillion in 2012, but is expected to reach $9 trillion annually in 2025 [PDF]. Much of this funding may come from fuel taxes, which are substantially higher in OECD nations outside of North America. The investments made—or not made—today will shape not only next year’s commute, but the ability of the U.S. economy to effectively compete and grow decades hence, many experts say.

More on:

Falling construction costs have helped to put transportation infrastructure projects in reach for the United States. The Federal Highway Administration’s (FHWA) National Construction Cost Index indicates that costs were elevated from 2005–2008, but have returned to historical norms. While previous FHWA reports found that highway funding was below the level required to just preserve the status quo, the 2013 report indicated that falling constructions costs allowed transportation investment to exceed replacement levels, but were still well short of making substantial improvement.

Dwindling Trust Fund

Despite the recent fall in construction costs, public budgets are straining to fund projects. The federal government provides about half of funds used for building and maintaining highways, primarily from the Highway Trust Fund (HTF) [PDF]. While states and local governments provide three-quarters of all public spending on highways, 60 percent of that spending is for operations, while almost all federal spending is capital investment.

Even at current spending levels, the HTF no longer collects enough revenue to fund highway and mass-transit projects. HTF collects 18.4 cents of gasoline excise tax per gallon (and a tax on diesel as well), a nominal rate that has not changed since 1993, even as gasoline prices have shot up dramatically, and inflation has reduced the U.S. dollar’s value by a third; the real federal gas tax rate is at its lowest point since 1990. Rising fuel efficiency and recent declines in the average miles travelled have depressed HTF income even further; the efficiency of the average passenger vehicle has risen from twenty-four miles per gallon 1980 to thirty-six in 2013.

Funding uncertainty imperils coordinating construction efforts with state and local governments, and potential private partners. In 2008, HTF could not cover the costs of construction projects through its funds and needed an infusion from the U.S. Treasury’s general fund. A total of $54 billion has been transferred since 2008 to cover the gap.

The HTF needs more revenue—the Congressional Budget Office calculates [PDF] a ten cent per gallon increase to make HTF solvent—but a hike is unpopular with the American public. In a 2011 poll by the Rockefeller Foundation [PDF], 66 percent indicated that improving transportation infrastructure was extremely or very important, but 71 percent said it was unacceptable to raise the federal gas tax rate, though large majorities supported alternative funding measures such as more private investment (78 percent) and creating a national infrastructure bank (60 percent).

Large majorities also were against new tolls, or moving to a vehicle-miles traveled (VMT) tax. VMT proponents argue that it would more directly tie to road use than the gas tax, and that revenues would not decline as cars get more efficient. VMT critics raise privacy and implementation concerns such as a need for an on-board system to report on mileage. Oregon is launching a pilot program [PDF] for five thousand motorists in mid-2015.

Mass Transit

Mass-transit capital spending on buses, trains, and subways is in worse shape than highway spending. The 2013 FHWA report indicates that even when including one-time Recovery Act funds, the $16.5 billion spent in 2010 on capital investments was below the $18.5 billion level to reach a good state of repair, let alone the $23.3 billion level to expand. Federal and local government combined to fund almost 87 percent of capital projects [PDF], with states covering the remainder. Public transportation is also widely subsidized; fares cover less than 38 percent of operating costs, with local and state governments making up most of the difference.

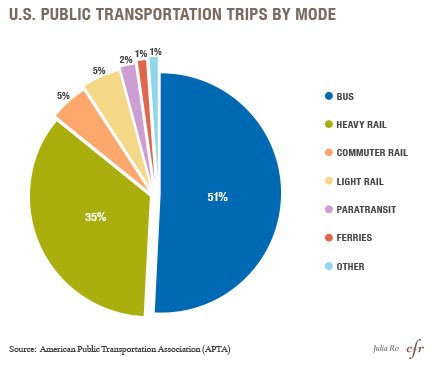

Approximately 7 percent of workers in the United States’ one hundred largest metropolitan areas (6.5 million workers) rely upon mass transit to reach their jobs, but research by Brookings [PDF] indicates considerable variability of access. On average, a resident can reach 30 percent of jobs in a metropolitan area via mass transit within ninety minutes, but that average masks a large discrepancy of access between urban (41 percent) and suburban (22 percent) job opportunities. Since higher skill jobs are more concentrated in cities, lower skilled workers typically have fewer mass-transit options. Most mass-transit trips are on a bus, with rail systems making up most of the rest.

Some high-profile large mass-transit projects are underway, such as a $5.6 billion project to link Washington, DC’s metro to Dulles airport by 2018. The project is largely funded by the airport authority, but the federal government provided $900 million in direct funding, and a loan of $1.9 billion. It is a recent solution to a decades old problem—one common to many U.S. cities—an airports many miles from downtown without a convenient mass-transit link.

Even without projects of that scale, cities could gain substantial leverage by better integrating existing mass-transit infrastructure to enable true door-to-door connections. Susan Zielinski of the University of Michigan recommends “New Mobility” hubs based on models deployed in Bremen, Germany that allow riders to seamlessly transition between different transportation modes. These systems are aided by recent technological innovations such as smartphones that enable real-time schedule tracking or booking a car share and network-wide payment cards like London’s Oyster Card.

The Obama administration has emphasized intercity high speed rail (HSR) projects since the Recovery Act, but so far, results have been disappointing. Multiple HSR projects have been cancelled by state governments, while new HSR lines exceeding two hundred miles per hour are being built in nations such as China, South Korea, Brazil, Saudi Arabia, and across Europe. While HSR could ease congestion at airports and on intercity highways, it is still unclear if they offer attractive returns. An analysis of high-speed rail [PDF] by the Congressional Research Service found it rarely generates enough revenue to cover all capital and operating costs, particularly since the United States is less densely populated and has higher car ridership.

Opportunity for the Private Sector

With traditional government-funded infrastructure investment in short supply, some policy experts are advocating for more private-sector involvement through public-private partnerships (PPP). Through municipal bonds, private capital often helps fund infrastructure, but a PPP is a project with direct cooperation via long-term contracts between the public and private sector in development, construction, operation, ownership, or financing. PPPs are also more appealing to pension funds and foreign investors who cannot benefit from the tax deductibility of municipal bonds.

Ultimately, there is a different balance of risks and returns between private investors and the state, and how risk is shared can differ wildly from project to project. Greater private-sector involvement can sometimes bring significant technological or operational expertise that can result in lower costs compared to a public-sector led effort. Some states and municipalities already lease transportation infrastructure to private investors in long-term agreements, such as the ninety-nine-year lease for the Chicago Skyway bridge. The leases allow local governments to bring forward future toll revenue for reinvestment in other projects or to balance a budget while private investors obtain a stable revenue stream. Sometimes efforts are slow to mature. Launched with great fanfare in 2012, the Chicago Infrastructure Trust was part of a broader $7 billion infrastructure plan for the Windy City, but since then only one small energy efficiency project has gotten underway.

The United States has relatively limited but growing experience with PPPs compared to pioneers such as Canada, Australia, and the United Kingdom. Even as the private sector’s role grows, governments will still be the prime actor for most infrastructure projects; successful PPP projects are often aided by national infrastructure offices that coordinate state and private action, such as PPP Canada, Infrastructure Australia, and Infrastructure UK. Not surprisingly, many of the largest infrastructure investors [PDF]—including global leader Australia’s Macquarie Group—are based in these nations.

CFR Senior Fellow Heidi Crebo-Rediker recommends that the federal government leverage its deep expertise by creating an advisory arm of the Treasury Department, “Infrastructure USA” to advise state and local governments in their efforts to leverage private capital to create public goods.

Online Store

Online Store