A bit more to worry about; foreign demand for long-term Treasuries has faded

More on:

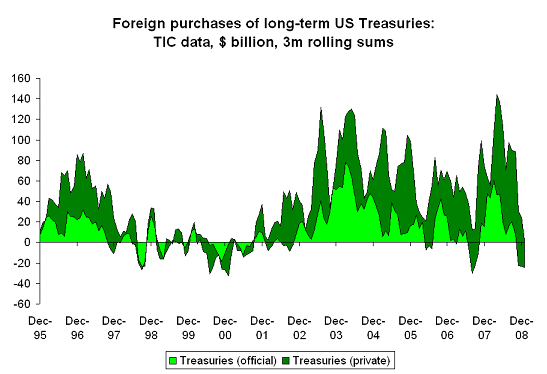

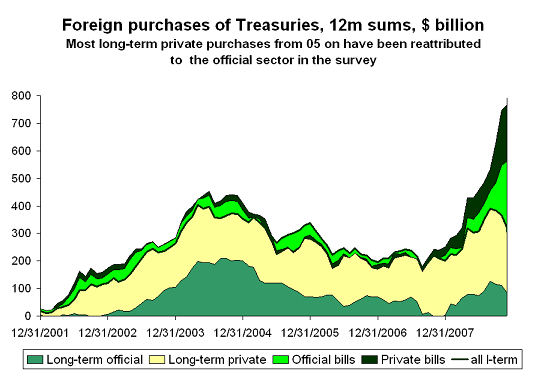

I wanted to highlight one trend that I glossed over on Monday, namely that foreign demand for long-term Treasuries has disappeared over the last few months. Consider a chart showing foreign purchases of long-term Treasuries over the past 3 months. Incidentally, the split between private and official purchases in this data should largely be ignored. The revised (i.e. post-survey) data generally have attributed nearly all the flow from 2003 to the official sector.

The rolling 3m sum bounces around a bit, but foreign demand for long-term Treasuries in November, December and January was as subdued as it has been for a long-time. Among other things, that fall in foreign demand for long-term Treasuries after October suggests -- at least to me -- that the big Treasury rally late last year (and subsequent sell-off this year) doesn’t seem to have been driven by external flows. Foreigners weren’t big buyers of long-term Treasuries back when ten year Treasury yields fell to around 2%.

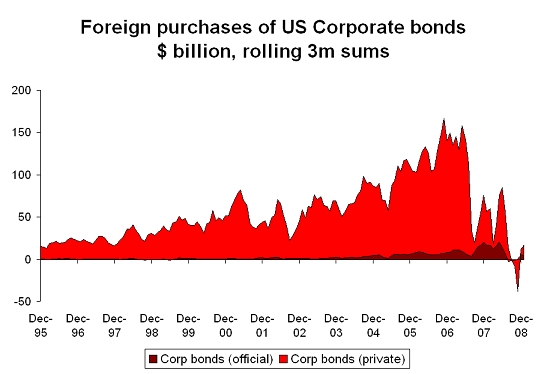

There also is at least a passing resemblance between a chart of foreign demand for US corporate bonds and foreign demand for Treasuries.

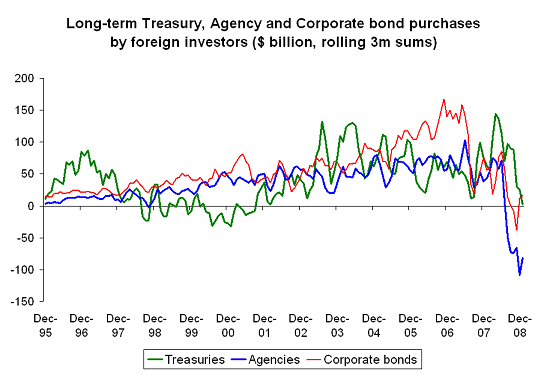

It is also striking that -- for all the talk of safe haven flows to the US -- foreign demand for all long-term US bonds has effectively disappeared.

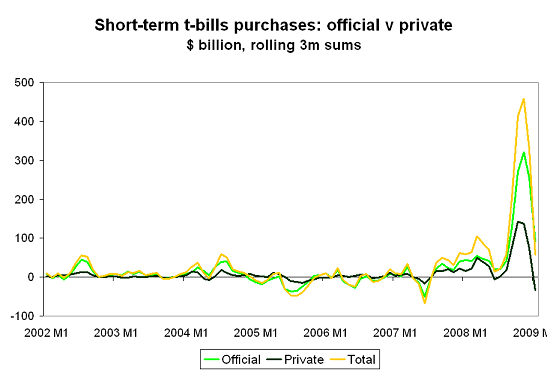

What have foreign investors been buying? Short-term Treasury bills. In huge quantities. On a rolling 3m basis, foreign investors bought nearly $500 billion in bills at the peak of the crisis.

However, that surge in demand for bills now seems to be fading.

The fall off in total TIC flows in January reflected private bill sales. The official sector is still buying -- $100 billion in bill purchases over the last 3 months of data only seems small relative to the post Lehman peak. But with global reserve growth slowing (even China doesn’t currently seem to be adding to its reserves), central banks won’t be as large a source of demand for Treasuries going forward as they have been in the past.

That means a fall off in central bank demand for Treasuries wouldn’t necessarily be a sign that central banks have lost confidence in the US Treasury market. It could equally be a sign that a lot of central banks no longer have any new funds to invest.

That said, a lot of central banks are now holding an awful lot of zero coupon (or close to it) bills. At some point they might be induced to buy somewhat longer-dated Treasuries to pick up a bit of yield. No trend -- including the current vogue for bills -- lasts forever.

Why does this matter?

Foreign demand for Treasuries hasn’t kept up with Treasury issuance, but it undeniably has been strong. Over the last 12 months, net foreign purchases of Treasuries financed much of the US current account deficit.

The trade and current account deficit has fallen substantially as a result of the fall in oil prices, so the US needs less external financing now than in the past. But it still needs some.

The "quality" of the financial flows into the US consequently bears watching. A modest revival in foreign demand for longer-dated US assets would be a positive sign. To date, the sale of US assets abroad and a scramble for liquid dollar assets has provided the US with more than enough financing to sustain its deficit. Those flows though may not continue.

And if -- as seems likely -- foreign demand for Treasuries fades long before the US fiscal deficit, the US Treasury will need to sell an awful lot of Treasuries to American investors. For the past several years I have argued that it was almost impossible to overstate the impact of central bank demand on the Treasury market.

That may no longer be the case going forward.

The world is changing. Global reserves aren’t growing. The echo from their past peak that we observe in the current Treasury data will fade.

More on:

Online Store

Online Store