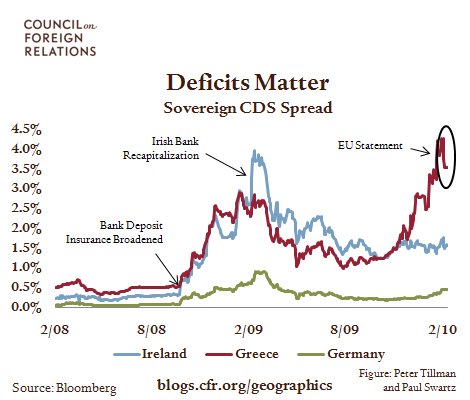

Deficits Matter

More on:

As the global financial crisis went viral in September 2008, governments stepped in with enormous financial commitments to prop up their financial systems. Markets became increasingly skeptical that sovereigns would be able to meet their obligations, as illustrated by soaring CDS spreads. Spreads began falling in March of 2009 as the financial system stabilized. Yet whereas Ireland pushed through unpopular spending cuts in early 2009, Greece failed to initiate serious measures to reduce public spending commitments. Consequently, markets began pushing up Greek CDS spreads in late 2009, producing an enormous gap vis-à-vis Irish spreads. Greek spreads narrowed slightly after the European Union made its vague pledge last week to “safeguard financial stability in the euro area as a whole,” but default fears remain high.

Economist: Europe's Financial Crisis

NYT: Wall St. Helped to Mask Debt Fueling Europe’s Crisis

More on:

Online Store

Online Store