The Fed Should Pledge to Stop Pledging for a While

More on:

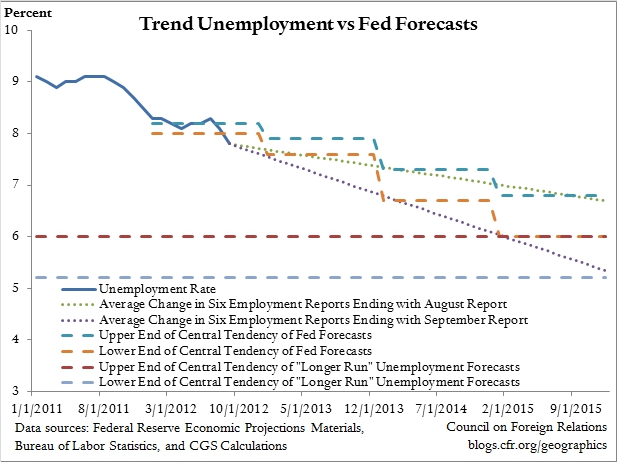

Back in February, Benn argued that the Fed’s three-year zero-rate pledge, combined with a 2% long-run inflation target, may have been a pledge too far, given the Fed’s poor forecasting record going back decades. The Board of Governors’ and Reserve Banks’ first three-year forecasts in October 2007, for example, were wildly off the mark: actual 2010 GDP, unemployment, and inflation were all outside the range of the 17 forecasts. Yet at its September meeting, the Fed’s Open Market Committee extended its zero-rate pledge into 2015, on the basis of its forecast that unemployment would still be significantly above their “longer run” expectation at that time—as shown in the figure above. But last week’s September payrolls report revealed that the unemployment rate had dropped more than anticipated, to 7.8%, putting the 6-month trend line into 2015 well within the Fed’s comfort zone. This implies that interest rates, by the Fed’s own reasoning, may well need to rise sooner. We think it’s time that the Fed pledged to stop pledging for a while.

FOMC: September 2012 Statement

FOMC: Economic Projections of Fed Board Members and Reserve Bank Presidents, September 2012

BLS: The Employment Situation—September 2012

CNBC: Fed Often Gets It Wrong In Its Forecasts on U.S. Economy

More on:

Online Store

Online Store