The PBoC - and the Economist - argue that exchange rates don’t matter, but look at this graph …

More on:

China's Vice-Premier Wu Yi, the Economist, Stephen Roach, William Pesek and no doubt a host of others all have argued that the US trade deficit with China has nothing to do with the RMB/ dollar.

But it sure seems like the US trade deficit is heading down against those parts of the world economy that have – generally speaking – allowed their exchange rates to appreciate, while the US trade deficit with Asia continues to rise.

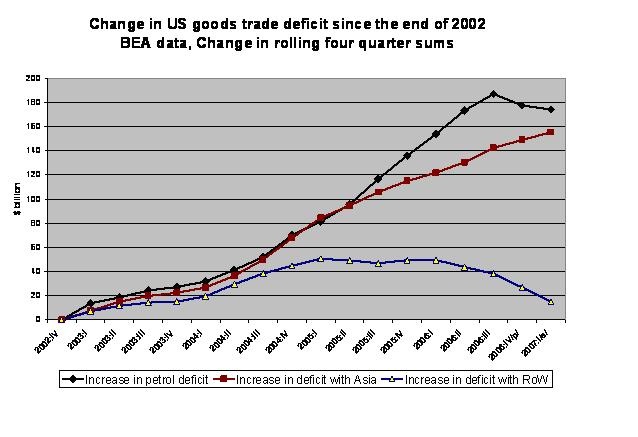

Look at the following graph. It shows the US goods trade deficits with Asia, the US oil balance and the US goods deficit with everyone else.

To make the numbers jump out, I plotted the change in the goods trade deficit from its end 2002 level of $480b. It subsequently rose to a high of $850b in q3 2006 (using a rolling four quarter sum to get annual data) before falling a bit. The graph tries to show what drove the deficit from $480b to $850b.

Tis true, the US deficit with the non-oil exporting world (excluding Asia) did rise in 2003 and 2004 even though the dollar was falling. But there is that pesky J curve. Import prices initially rise, offsetting changes in import and export volumes. Only over time does the overall deficit fall. And the US dollar was – let’s not forget – very strong in 2001 and 2002. Some of the lagged impact of the strong dollar was still present in 2003 and 2004. By 2005 and 2006, though, the lagged impact of the 2003-2004 fall was starting to exert itself.

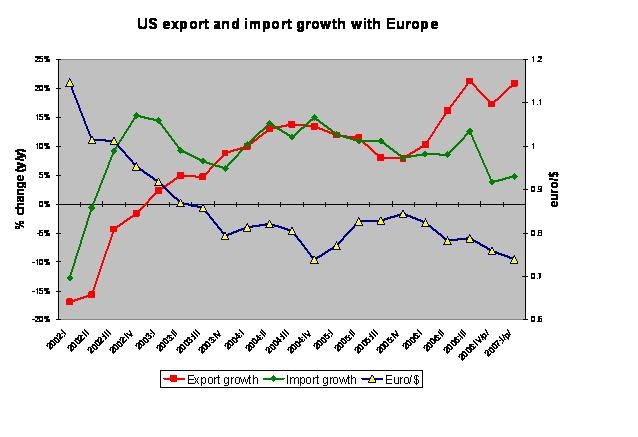

And even if the US trade deficit -- which depends on both export and import growth -- didn't come down when the dollar started to fall, it is clear that the 2003 slide in the dollar had a much more immediate impact on the pace of export growth.

Just look at the acceleration in US export growth to Europe.

The acceleration in export growth that followed the dollar's decline against the euro is, I think, more or less what the latest econometric analysis tell us should happen. Changes in the real exchange rate tend to have a bigger impact on US exports than imports.

The dollar isn’t the only factor that influences the trade balance. Relative growth rates matter. In 2004, the US was growing much faster than Europe. By 2006 and 2007, though, things had changed. Combine a weak dollar with stronger growth outside the US than inside the US and presto, a shrinking deficit. The expected adjustment did happen.

That expected adjustment just hasn’t started with Asia. That hurts. High oil prices don’t help either.

And pretty soon, the income balance is likely -- at least in my view -- to turn negative. That won't help the current account deficit. The world's central banks better be prepared to finance the US for a long time ...

One technical note. The BoP series that I use for these graphes hasn’t yet been updated for q1, so I drew on the trade data to estimate the q1 deficit with various parts of the world. The balance for the rest of the world has been calculated as a residual. It is the goods deficit - the deficit with East and South Asia - the oil deficit.

More on:

Online Store

Online Store