The Politics of Debt Brinkmanship

More on:

CFR.org has posted a piece I wrote on the stalemate in the debt ceiling negotiations. Much of President Obama’s press conference yesterday was about framing the discussion of who should be blamed if an agreement is not reached in time to stave off a default. He knows that he gains leverage in the negotiations if Americans accept his claim that the GOP is courting economic disaster with a "my way or the highway" attitude. It’s an open question whether the president’s use of the bully pulpit will shift public opinion much in our current partisan environment.

The wild card in the negotiations is whether John Boehner can persuade his caucus to vote for the deal he strikes with the White House. Boehner’s vulnerabilities within his caucus have been obvious since he was elected speaker. Several of his lieutenants look to be eyeing his job, many rank-and-file House Republicans don’t want to give an inch to the White House, and many Tea Partiers don’t believe that the federal government will default or that a default will be a big deal. To make matters worse, GOP presidential candidates are egging on the Republican hardliners. As Chris Cillizza points out:

The reality that congressional Republican leaders have to deal with is that there is almost no political benefit for any of their party’s potential presidential nominees to sign off on any sort of debt ceiling deal that they had absolutely no influence in crafting.None of them—with the exception of Bachmann who has already said she will oppose any debt ceiling increase—has to vote on a compromise and none of them will be held accountable if a deal isn’t made and the U.S. defaults on its loans.

So far the lack of progress in getting a deal and speculation that the House might reject any deal that Speaker Boehner negotiates hasn’t fazed the financial markets. The betting money is Washington will get a deal done, but only at the last possible minute. So everything between now and the end of month is sound and fury signifying nothing.

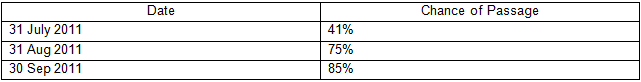

If you think the conventional wisdom is wrong, you can trade in Intrade.com’s predictive markets. It currently has contracts trading on the proposition that Congress will vote to approve an increase in the U.S. debt ceiling to $15.1 trillion by three different dates:

How will we know if the financial markets change their mind about the chances of getting a deal? The stock market will go down and interest rates will go up. That change can come about with great speed. Neil Bouhan, a crack analyst here at CFR, tells me that the borrowing cost on Italian ten-year bonds (I buoni) was a shade under 5 percent when the market closed on July 5. Yesterday it closed at 6.683 percent. The yield rose 168 basis points, to borrow Wall Street parlance, in less than a week because bond traders got spooked about Italy’s debt problems.

(I know, Italy’s problems are different from the one the United States faces today. My point simply is that market sentiment can change quickly, often faster than governments can react.)

A question for you: What will the consequences be for American power around the world if the conventional wisdom is wrong and Congress does not raise the debt ceiling in time? A hiccup that will pass unnoticed? A pivotal moment that historians will write books about? Something in between? I have my answer, which I will post later this week. But I would like your take.

More on:

Online Store

Online Store