A U.S. Budget Deal that Matters

More on:

This is what governing looks like.

When outgoing speaker John Boehner promised to “clean the barn up a little bit” before leaving, there was understandable skepticism that a large number of must-pass pieces of legislation could be sheparded through a sharply divided congress. From that perspective, last night’s agreement on a budget framework—if it holds—looks to be an important step forward. While far from ideal budgetary policy, it removes substantial tail risk from U.S. economic policymaking between now and the election.

The agreement reached last night would suspend the debt limit until March 2017, ease the sequester caps for fiscal year 2016-17 (allowing a roughly $80 billion increase in spending over two years split evenly between defense and non-defense spending), and provide fixes for a substantial array of items for 2016, including temporary relief from Medicare premium and Social Security disability rate hikes. Two other pieces of legislation—a temporary extension of the highway bill and the reopening of the Export-Import Bank (Ex-Im), were not included in the deal but look to be moving forward on separate tracks, with the House likely to vote for Ex-Im reauthorization today. The roughly $1.5 trillion debt limit increase is the centerpiece of this agreement and clearly most important to markets.

The package does not extend funding for the government, and the current spending bill expires on December 11. The hope here is that, by setting the top line numbers and easing the sequester, it makes the ultimate agreement on a full-year spending bill (omnibus) much easier and reduces (but doesn’t eliminate) the risk of a government shutdown. I tend to agree, though as Chris Krueger of Guggenheim Securities emphasizes, Republicans are likely to push for a number of policy riders (e.g., Planned Parenthood defunding) around that December 11 cliff, marking a difficult first test for Paul Ryan as speaker. The debate over temporary tax measures ("extenders") also will be tough, and potentially meaningful for the budget. Further, there is still “deal risk”—a stumble that prevents passage before the November 3 debt limit deadline. Still, we have managed through these type of spending showdowns in the past without a material disruption to the U.S economy, and the odds of going off the cliff in December now look reduced.

In terms of spending, the measures are “paid-for” in a budgetary sense through promised longer-term savings including reform to Obamacare, revenue measures and changes to the strategic petroleum reserve. In fact, the package may be budget positive over a ten year horizon. Still, the net effect on current spending is stimulative. Alec Phillips of Goldman Sachs estimates that the package will increase fiscal spending and raise GDP growth by 0.1 percent to 0.2 percent in 2016 and 2017. If the deal reduces market volatility from what it would have been in a debt showdown, the benefits could be even larger.

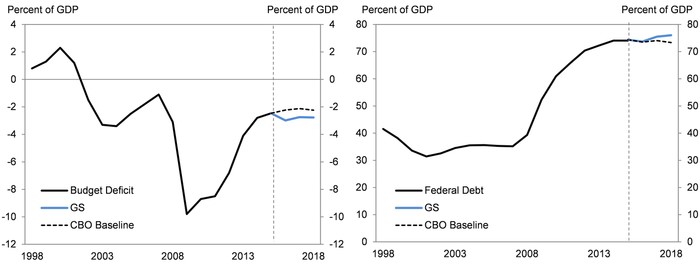

Assuming this package passes, the deficit is likely to be around 3 percent of GDP in FY16 (which started on October 1), and slightly lower in subsequent years, which is consistent with a stable debt ratio in the near term (See Goldman Sachs and CBO forecast below). Forecasts for the longer term are more art than science but there is near uniform agreement that we face a worrisome deterioration in the deficit and debt levels as the population ages and interest rates normalize, with the rapidity of the deterioration dependent on the pace of increase in health care costs. This deal does not address those concerns. But at a minimum, we appear to have taken a destructive and unnecessary debt-limit showdown off the table. Further, we can hope for a temporary end to destructive fiscal cliffs and economic policy standoffs that we have weathered over the last three years, despite a political campaign driven by populist calls for confrontation. And that is worth noting.

Chart: A Stable but Slightly Larger Deficit for the Next Few Years

Source: Congressional Budget Office, Goldman Sachs Global Investment Research

More on:

Online Store

Online Store