The US March trade data ...

More on:

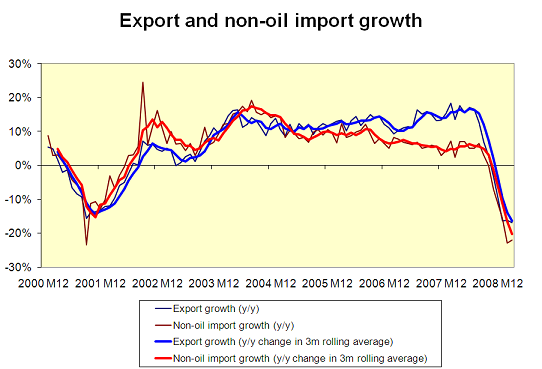

The March US trade data can be spun many ways. Imports and exports continue to be down substantially relative to last year. The smaller y/y decline in March than in February is a function of the fact that both imports and exports were unusually weak in March 2008 -- which improves the base -- rather that a rebound in volumes this year. But the pace of decline also does seems to have stabilized.

Broadly speaking -- after taking account the effect of last year’s weak base in March -- nominal non-oil goods imports are down around 25% -- and real goods imports are down around 20% y/y. Nominal non-oil goods exports are down around 20%, and real goods exports are down by between 15 and 20%. Adding services to the picture doesn’t change the story much. The fall in non-oil imports has exceeded the fall in non-oil exports.

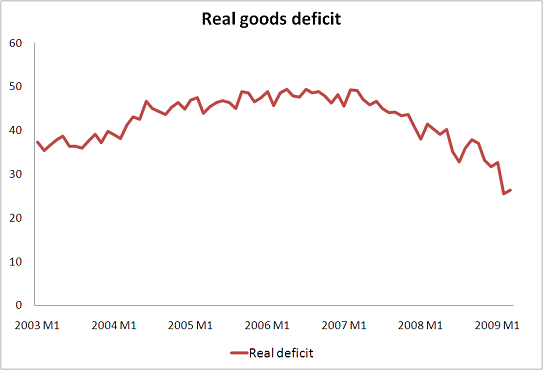

That means that the nominal non-oil balance has improved even as overall trade has contracted. The non-petrol goods deficit was 23.1 billion in March -- up ever so slightly from the $22.8 billion deficit in February. But the non-petrol deficit was around $37 billion this time last year. That is a substantial improvement.

And the petrol deficit is obviously way down.

That means, among other things, that the US is importing far less savings from the rest of the world -- remember, the trade deficit is a good proxy for the total sum the US is borrowing from the world -- than it was a year ago even though the fiscal deficit has gone way up. In other words, the rise in private savings and fall in private investment -- and thus the change in the private sector’s net balance -- has been bigger than the rise in the fiscal deficit.

There is a bit of evidence that the improvement in the trade deficit is close to ending. Calculated Risk’s charts show that the non-oil deficit has stabilzied. The (small) rebound in oil prices means that the petrol bill will soon head up a bit. And if the fiscal stimulus drags up overall US demand, US imports should start rising. If US exports don’t also bounce back, that would imply that the deficit would start to rise as well.

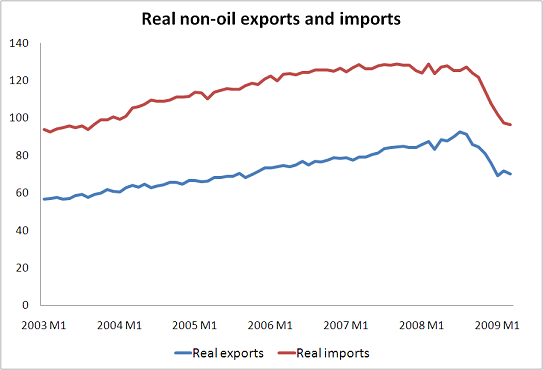

For now, though, the data show that both real imports and real exports have stabilized at much lower levels than a year ago -- and that the fall in real imports was bigger than the fall in real exports, generating an improvement in the real trade deficit.

If nothing changes -- or if real imports and real exports start to head up in parallel -- the improvement in the trade balance will be sustained.

There is also an interesting story -- or rather an interesting set of stories -- in the bilateral trade data.

Consider three Asian economies.

US imports from China are down 11% in the first quarter, i.e. the fall in US imports from China has been substantially smaller than the overall fall in US non-oil imports. US exports from China by contrast are down nearly 20%. That just doesn’t come through though in reporting that tries to argue that China’s stimulus is spurring activity in the US. Given the huge gap between the amount the US imports from China and the amount the US exports to China, China will need to do a lot more -- and import a ton more -- to pull the US up.* On the other hand, the bigger percentage fall in US exports to China hasn’t translated into a growing bilateral deficit (comparing q1 09 to q1 08) because the fall in imports is coming from a much larger base. The only goods news is that the y/y fall in US exports to China in March (5.5%) was substantially smaller than the y/y fall in January and February -- but then again so was the y/y fall in US imports from China (12.3% in March).

US imports from Korea are down 22.9% in the first quarter (20.5% for March) but US exports to Korea are down more -- 39% in the first quarter and 36% in March. There too the trade balance isn’t improving.

US imports from Japan by contrast are down 41.8% in the first quarter (and 46% in March). US exports are down a comparatively modest 22.9% in the first quarter (and 20.5% in March).

That is a big reason why Japan’s global surplus has fallen -- and why the US global surplus has fallen. In this case, the bilateral data with the US and the global data tell a similar story; Japan’s surplus overall surplus has fallen while China’s surplus has stayed roughly constant (it was up a bit in q4, but the April 09 surplus is roughly equal to the April 08 surplus).

US imports from the Eurozone are also down by more (24.6% in the first quarter) than US exports to the Eurozone (22.6% in the first quarter).** The US should send special thanks to France -- US exports to France were essentially flat in the first quarter of 2009, while US imports from France were down 20%.

On other interesting tidbit. Lower oil prices haven’t translated into higher oil demand. Prices in 2009 are about half their level at this time in 2008. But total imports -- in volume terms -- are still down by almost 5% in the first quarter.

There has been a lot of talk about how the US now sees eye-to-eye with China but not Europe on the need for stimulus. Yet in a lot of ways, the data suggests that the need for further adjustment in the Sino-American trading relationship still remains much larger than the need for further adjustment in the European-American trading relationship -- in part because a long period of dollar weakness against the euro really did bring the US deficit with Europe down, and in part because Europe’s automatic stabilizers should help to soften the amplitude of the downturn in European demand.

Then again, the impact of different policy responses will be felt more going forward -- and the April data from China provided a bit of good news, namely that the contraction in China’s imports looks to have ended before the contraction in China’s exports. That is good news for the world - as it implies that China’s growth is being driven by domestic demand now, not by exports.

* China’s stimulus also can impact the US indirectly, as say Brazil exports more to China and then imports more from the US.

** The March data isn’t much different. Exports are down 20.9% y/y while imports are down 22.6%.

More on:

Online Store

Online Store