US slumps, trade deficit doesn’t shrink …

More on:

The reasons why the US slowdown -- led by a fall in investment -- didn't lead to an improvement in the trade balance in the first quarter aren't that hard to find.

Consumption growth was actually very strong -- nearly as strong as in 2004 (see p. 5) . That was a year when the trade deficit really widened. Strong consumption growth pulled in imports -- especially, I suspect, Asian imports. Canada exports lots of wood and autos, and neither housing or the US automobile sector is doing well right now. And European exports to the US face the a large currency headwind.

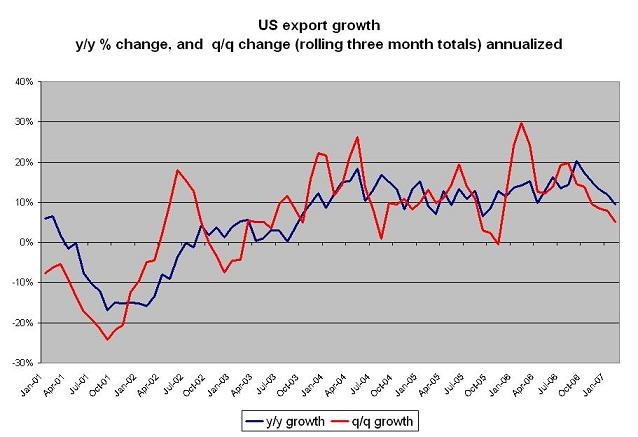

But what of exports? Shouldn't a booming global economy -- and weakish dollar -- help boost US exports? In theory, yes. But that didn't happen in the first quarter. The BEA estimates exports fell a bit in q1 (v. q4). And looking at the US export data, I can see why. The y/y rate of export growth has slowed -- and the q/q growth rate (using a rolling three month sum that takes December-February as the last quarter) has been decelerating sharply for the past couple of months.

What happened? To be honest, I don't know. Part of it is that export growth was very strong in q4, and net exports contributed very strongly to growth in q4 (see p. 6). That set a high base.

Part of it is that the dollar isn't really all that weak. It is very weak -- it hit a record low v the euro today -- against all European currencies. And it is weak against the commodity-exporting, high carry, high current account deficit countries in the South Pacific. But it isn't weak against the yen, against the RMB or against many other emerging currencies. The story right now is generalized euro strength, not generalized dollar weakness.

That matters. Net exports didn't contribute positively to US growth in the first quarter. But they contributed very positively to China's growth in the first quarter. The US needed a boost. China didn't. So long as dollar weakness (against europe and some others) means RMB weakness (against europe and some others) it may do more to boost the Chinese economy than the US economy.

Globally, a fall in the commodity exporters' surplus will be offset by a rise in Asia's surplus, not a fall in the US deficit. That clearly is what happened in q1.

Since private capital wants to flow into Asia, not flow out of it, the rise in Asia's surplus also means that Asian central banks -- with a bit of help from Latam and Russia -- had to finance a growing share of the US deficit. That also clearly happened in q1.

A fall in investment usually generates an improvement in the current account deficit. That didn't happen in the US, at least not in q1. Savings -- by definition -- fell faster than investment. Presumably US households drew on their savings to support ongoing strong consumption growth.

A guess that shouldn't be a total surprise. A surge in investment usually leads to a deterioration in the current account balance. That happened in the US in the late 90s -- and again from 2003-05, when residential investment surged. But the huge surge in investment in China has been associated with a growing external surplus. Savings has increased more.

My interpretation of all this? No shock. The de facto US-Chinese currency and monetary union has introduced a lot of distortions into the global economy. It is a strange monetary union. The faster growing portion of the monetary union has lower interest rates than the slower growing portion of the monetary union (because of expectations of RMB appreciation). And it has led the real exchange rate of the industrialized economy with the largest current account surplus to depreciate even as its economy booms ...

More on:

Online Store

Online Store