Which Fed Guidance Should We Believe?

More on:

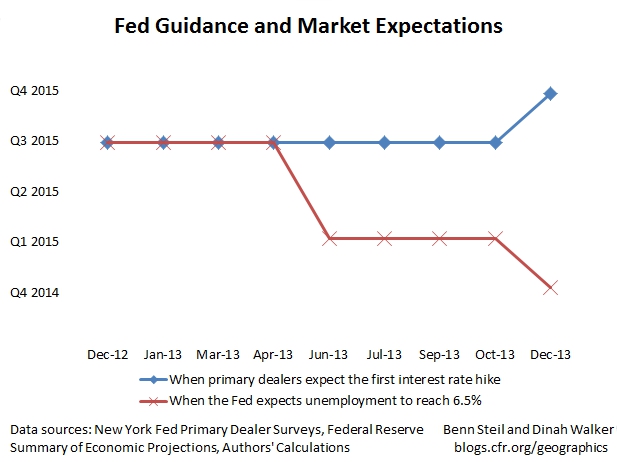

In October 2012, the Fed issued what came to be called a “pledge” to keep its target interest rate near zero through mid-2015. The market immediately reacted as the Fed wanted, centering expectations on a rate hike in mid-2015.

At its next meeting, the Fed abandoned date-based guidance in favor of data-based guidance: a pledge to keep rates near zero until the unemployment rate fell below 6.5%. The Fed emphasized, however, that the two pledges were consistent, as it didn’t expect unemployment to fall below that level until mid-2015.

The Fed justified the shift from date-based to data-based guidance by stating that the latter “could help the public more readily understand how the likely timing of an eventual increase in the federal funds rate would shift in response to unanticipated changes in economic conditions and the outlook.” But has it?

Fast forward, and the unemployment rate has been falling much faster than the Fed anticipated back then; the Fed now expects it to dip below 6.5% later this year. Yet the market has revised its rate expectations in the opposite direction; it now believes a hike will not come until late 2015.

For its part, the Fed has said nothing to nudge the market toward its amended (data-based) guidance; in fact, it is now suggesting that rates are likely to stay low “well past the time” the unemployment rate reaches 6.5%.

Chairman Bernanke had in June of last year also indicated that QE3 monthly asset purchases could be expected to end when unemployment hit 7%, whereas a tapering of asset purchases is only now just starting with unemployment at 6.7%.

All this suggests that the Fed’s experiment with data-based guidance is a flop. The 6.5% guidance may have been announced to help the public understand how the Fed would respond to “unanticipated changes in economic conditions,” but the Fed appears to have buried it because the unanticipated changes in the unemployment rate came about for unanticipated reasons – in particular, a big drop in the labor force participation rate.

Before the Fed moves on to the next generation of guidance markers, it ought to think twice about the risks of worsening, rather than improving, the signal-to-noise ratio in its communications. The jolt to the bond markets from the chairman’s unanticipated taper talk last May suggests what’s at stake as the Fed reverses the trajectory of policy from accommodation to tightening.

New York Fed: Primary Dealer Surveys

Federal Reserve: Minutes from the December 11–12, 2012 FOMC Meeting

Financial Times: Four Problems That Question the Efficacy of Forward Guidance

Hilsenrath: Jobs Report Alone Unlikely to Alter Fed’s Course

Follow Benn on Twitter: @BennSteil

Follow Geo-Graphics on Twitter: @CFR_GeoGraphics

Read about Benn’s latest award-winning book, The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order, which the Financial Times has called “a triumph of economic and diplomatic history.”

More on:

Online Store

Online Store