- China

- RealEcon

-

Topics

FeaturedInternational efforts, such as the Paris Agreement, aim to reduce greenhouse gas emissions. But experts say countries aren’t doing enough to limit dangerous global warming.

-

Regions

Featured

-

Explainers

FeaturedThis interactive examines how nationwide bans on menthol cigarettes and flavored cigars, as proposed by the Biden administration on April 28, 2022, could help shrink the racial gap on U.S. lung cancer death rates.

Interactive by Olivia Angelino, Thomas J. Bollyky, Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

-

Research & Analysis

Featured

Report by The Council of Councils June 30, 2024

-

Communities

Featured

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023

-

Events

Featured

Virtual Event with Emma M. Ashford, Michael R. Carpenter, Camille Grand, Thomas Wright, Liana Fix and Charles A. Kupchan June 25, 2024 Europe Program

- Related Sites

- More

February 22, 2013

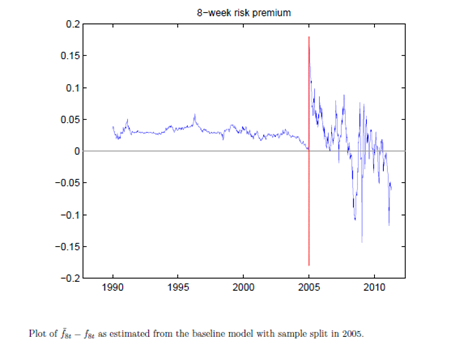

Fossil FuelsAs part of a book I’m working on, I’ve spent some time wading through the econometric literature on speculation in commodity markets, oil in particular. This body of research tries to shed light on h…

February 21, 2013

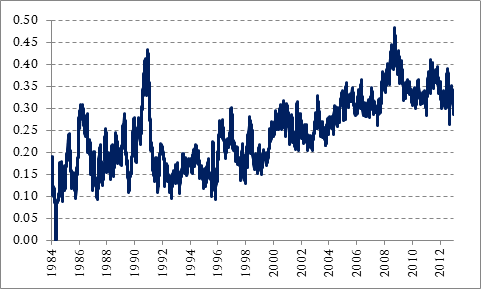

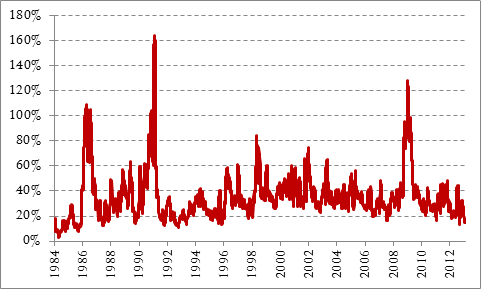

Fossil FuelsIn a post earlier this month, I showed that by some measures crude oil price volatility is nearing a low ebb historically, though looking at historical volatility in isolation can mask the magnitude …

February 13, 2013

One of the most misunderstood topics in energy markets is the role speculation plays in them, and specifically how buying and selling by financial market participants affects market behavior. Public …

February 7, 2013

Fossil FuelsOkay, so the title of this post is tongue-in-cheek: the U.S. president has far less power to influence gasoline prices than campaign-season banter would lead you to believe. But I figure if a sitting…

February 5, 2013

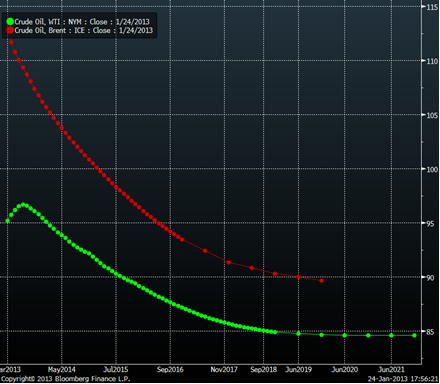

Fossil FuelsIn my last post I discussed how trading volumes show a migration into ICE Brent from NYMEX West Texas Intermediate (WTI), two of the world’s most watched crude oil benchmarks. The trend is part of Br…

Online Store

Online Store