Tightening? What Tightening?

More on:

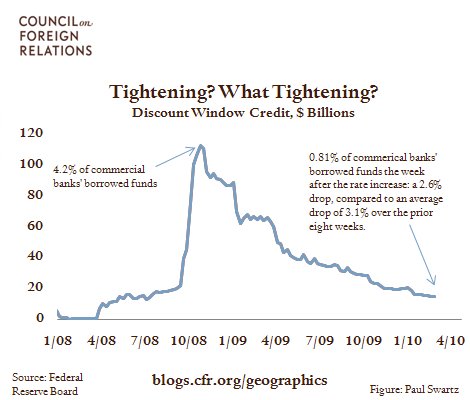

At 4:30 p.m. on February 18th the Federal Reserve Board announced an increase in the discount rate, the rate charged for direct lending to banks, by 25 basis points (0.25%) to 75 basis points. When Asian equity markets opened a few hours later they traded down about 2%, on fears that the move signaled the start of tightening credit. Yet borrowing from the discount window, which peaked in the midst of the financial crisis in October 2008 at an historically high 4.2% of commercial banks’ borrowed funds, is unlikely to be affected by the rate increase. Banks borrow from the discount window because they have no other options. The week after the rate increase discount window borrowing dropped by only 2.6%, compared to an average of 3.1% over the prior eight weeks. In itself, then, the move was a non-event. The question remains whether the Fed, despite its protestations, engineered this non-event to begin preparing the market psychologically for increases in the far more consequential fed funds rate – the rate at which banks lend reserves to each other.

Federal Reserve: Press Release

Hilsenrath: Rate Rise Stirs Questions

Politi: Fed Seeks To Clarify Discount Rate Move

More on:

Online Store

Online Store